Payment Delay

Cash Management

This article explains how Payment Delays work in Calqulate. This will contribute also to your Cashflow forecasting. However, you need to map your Chart of Account first and set up all Cash links.

Every invoice and every cash transaction has an assigned payment date. If you want to forecast your cashflows, you need an assigned payment date for each transaction. If you do not add a date in the cashflow forecast, your forecast may not be accurate.

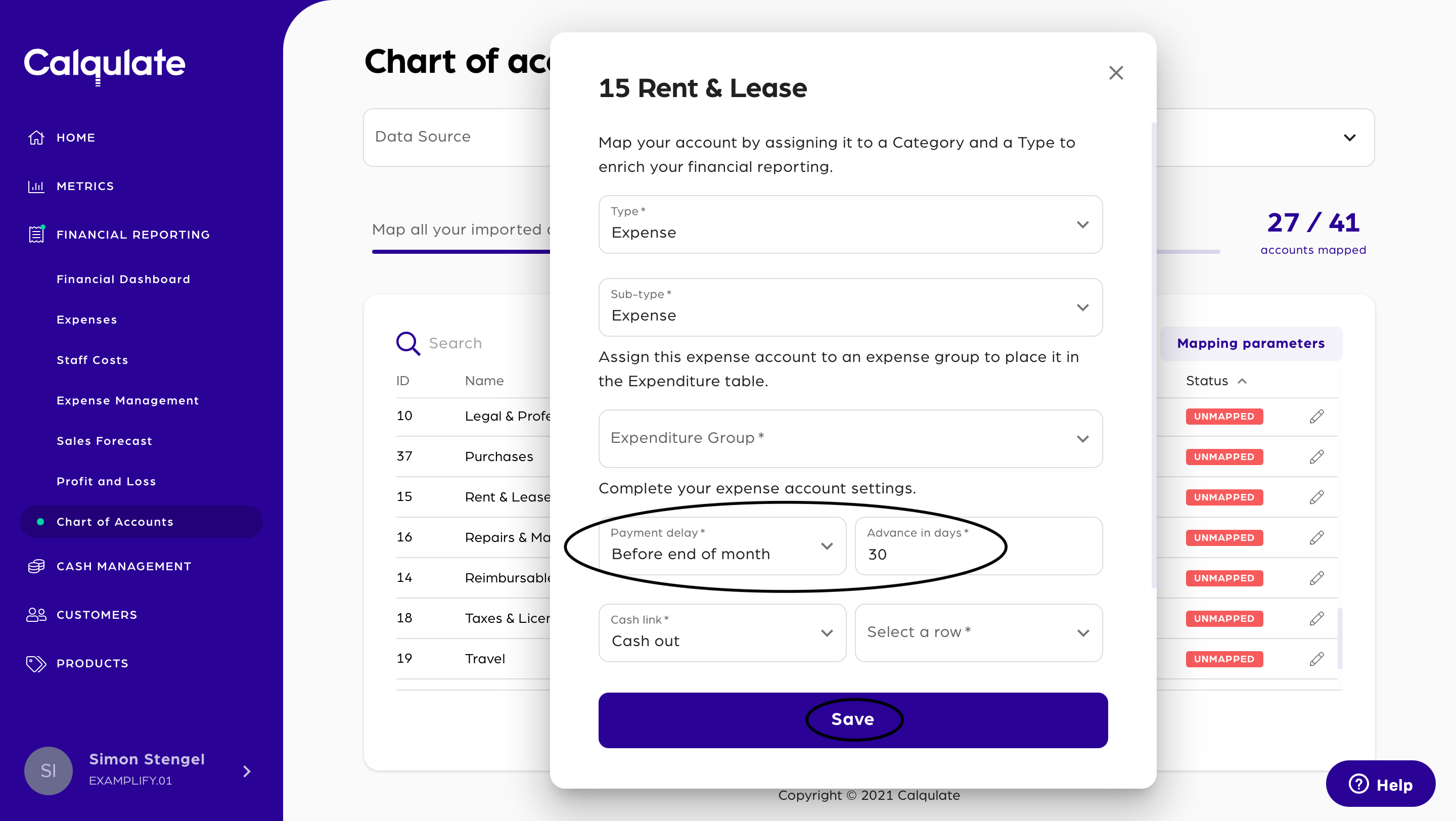

Let's take your rent and insurance payments as an example. Rent is often paid at the beginning of the month. Insurance payments are often paid a month after the invoice date.

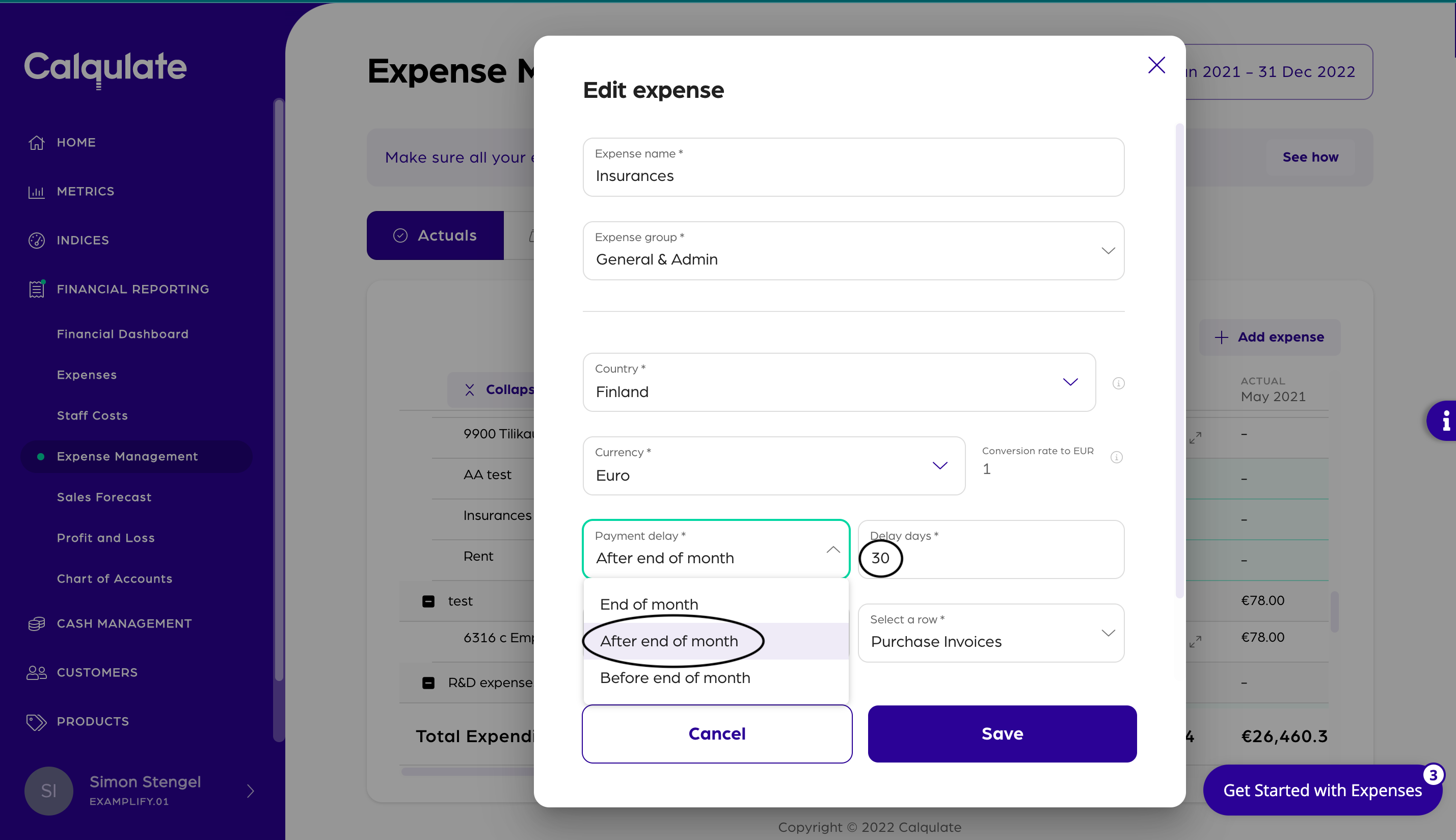

Using the above examples, in Calqulate you would set the following delays:

For the rent, you should select payment in advance with 30 days

For the insurance you should select payment delay with 30 days

How to set up a Payment Delay in the Expense Management

In total, there are three ways to set up payment delays in Calqulate. You can do it while you map you Chart of Accounts, while adjusting your default values for Staff costsor in the Expense management.

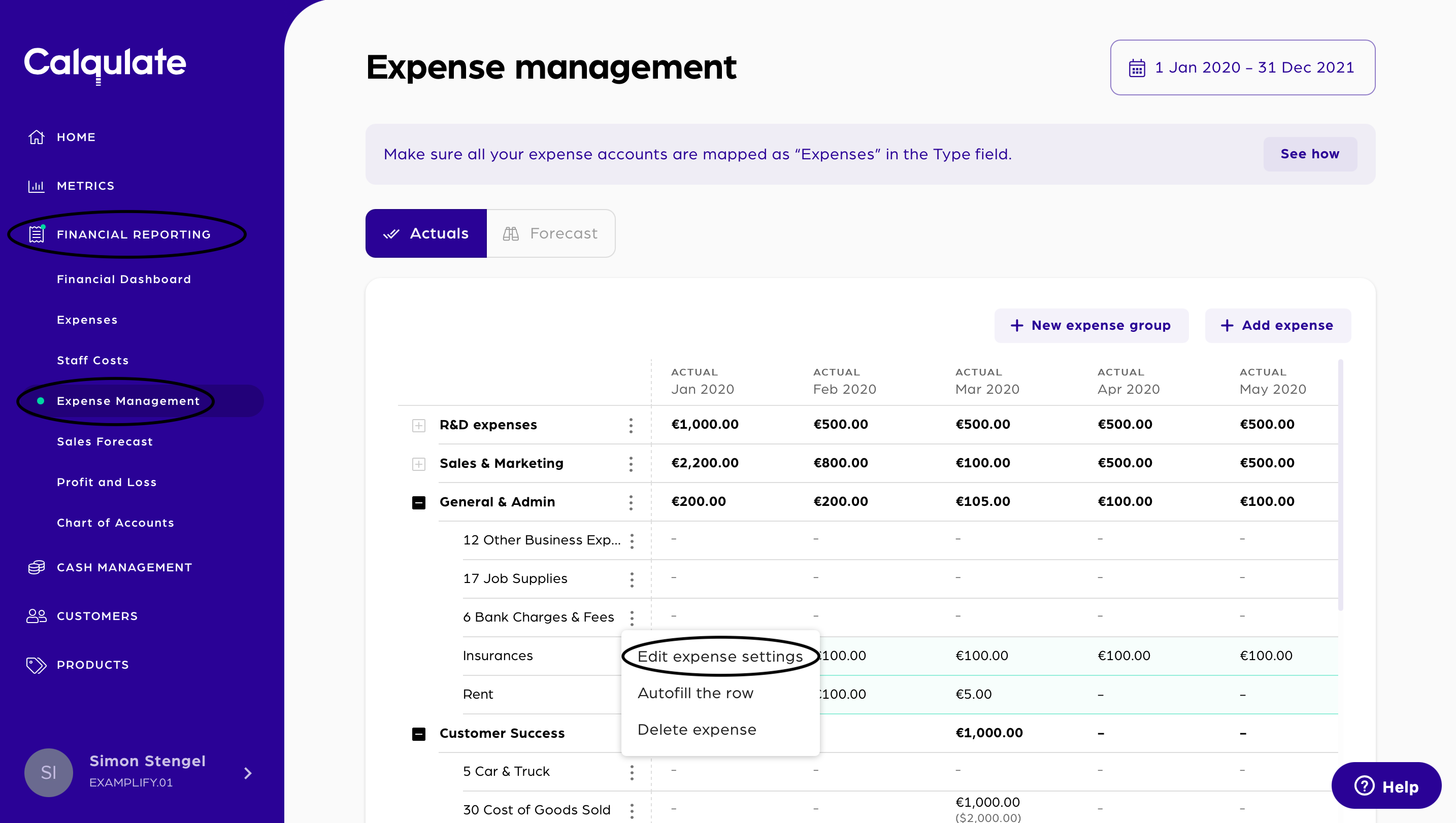

To set up delays for payments in the Expense Management, go to the left-hand menu FINANCIAL REPORTING > Expense Management. Click the three-dot action menu next to the expense you want to edit and click Edit expense settings.

You can now choose if you want to set the payment to:

End of month

After end of month (Add Delay in days)

Before end of month (Add Advance in days)

Confirm with Save.

You have now added a payment delay or advance in the Expense Management for an expense.

How to set up a payment delay in the Chart of Accounts?

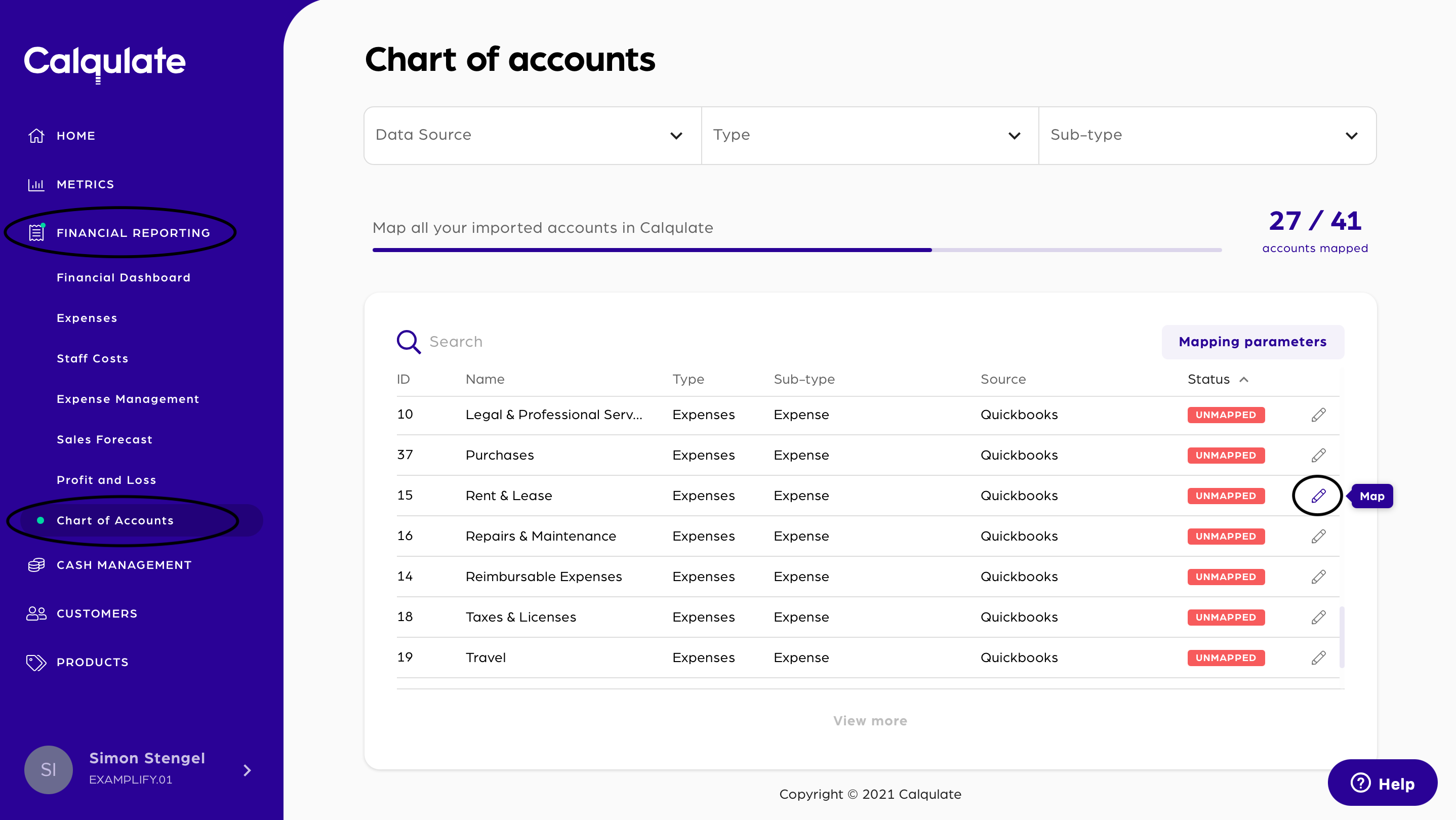

The second place where you can add a payment delay is the Chart of Account. Go to the left-hand menu FINANCIAL REPORTING > Chart of Accounts. You can adjust the payment delay for mapped or unmapped accounts. Search for the account you want to adjust and press the pencil icon on the right side.

You can now choose if you want to set the payment to:

- End of month

- After end of month (Add Delay in days)

- Before end of month (Add Advance in days)

Confirm with Save.

You have now added a payment delay or advance in the Chart of Accounts.

How to set up a Payment Delay for Staff costs

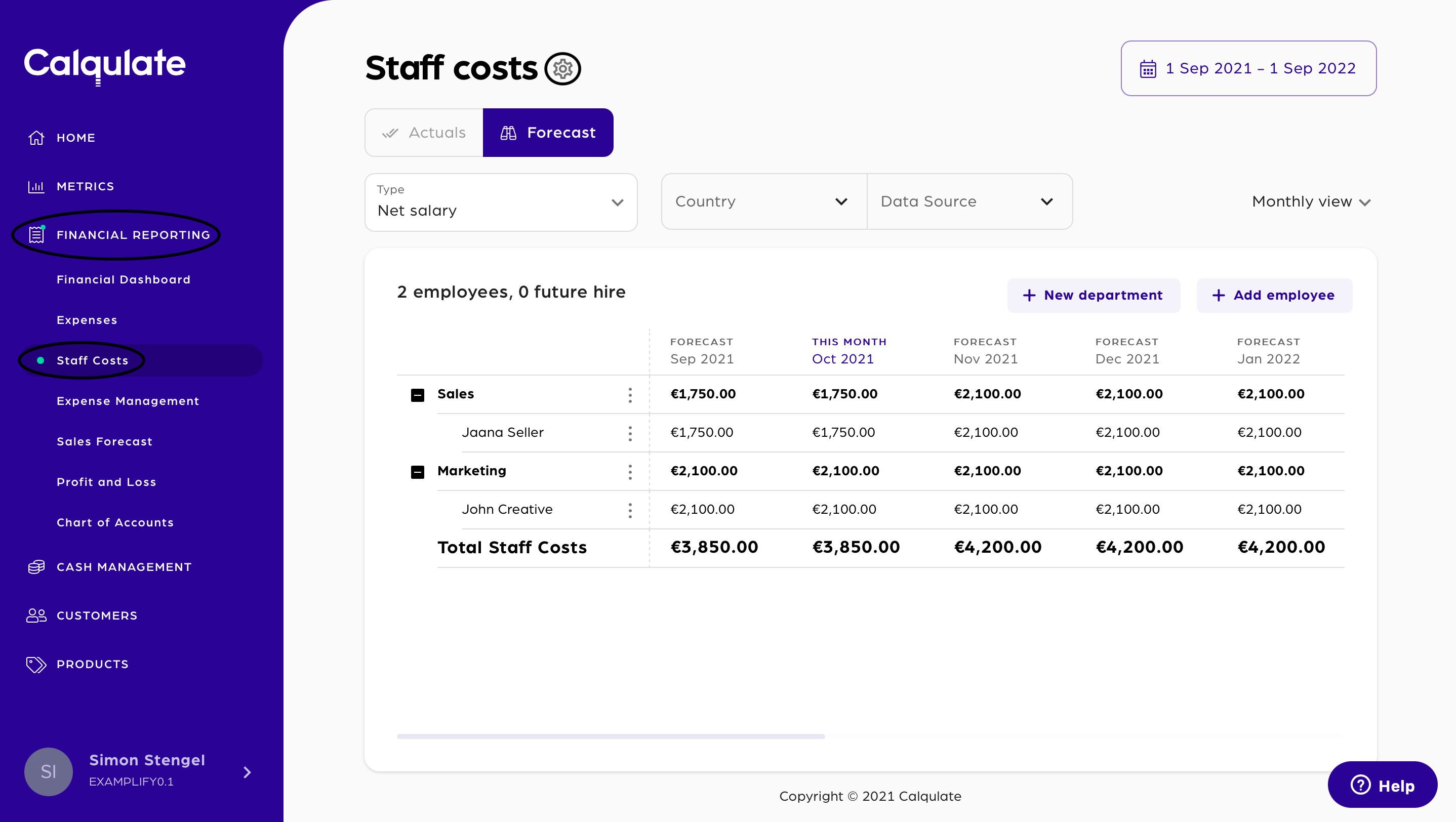

Setting up payment delays for Staff costs works a bit differently. Go to the menu on the left-hand side and click FINANCIAL REPORTING > Staff Costs. Click the gear icon next to the headline Staff costs.

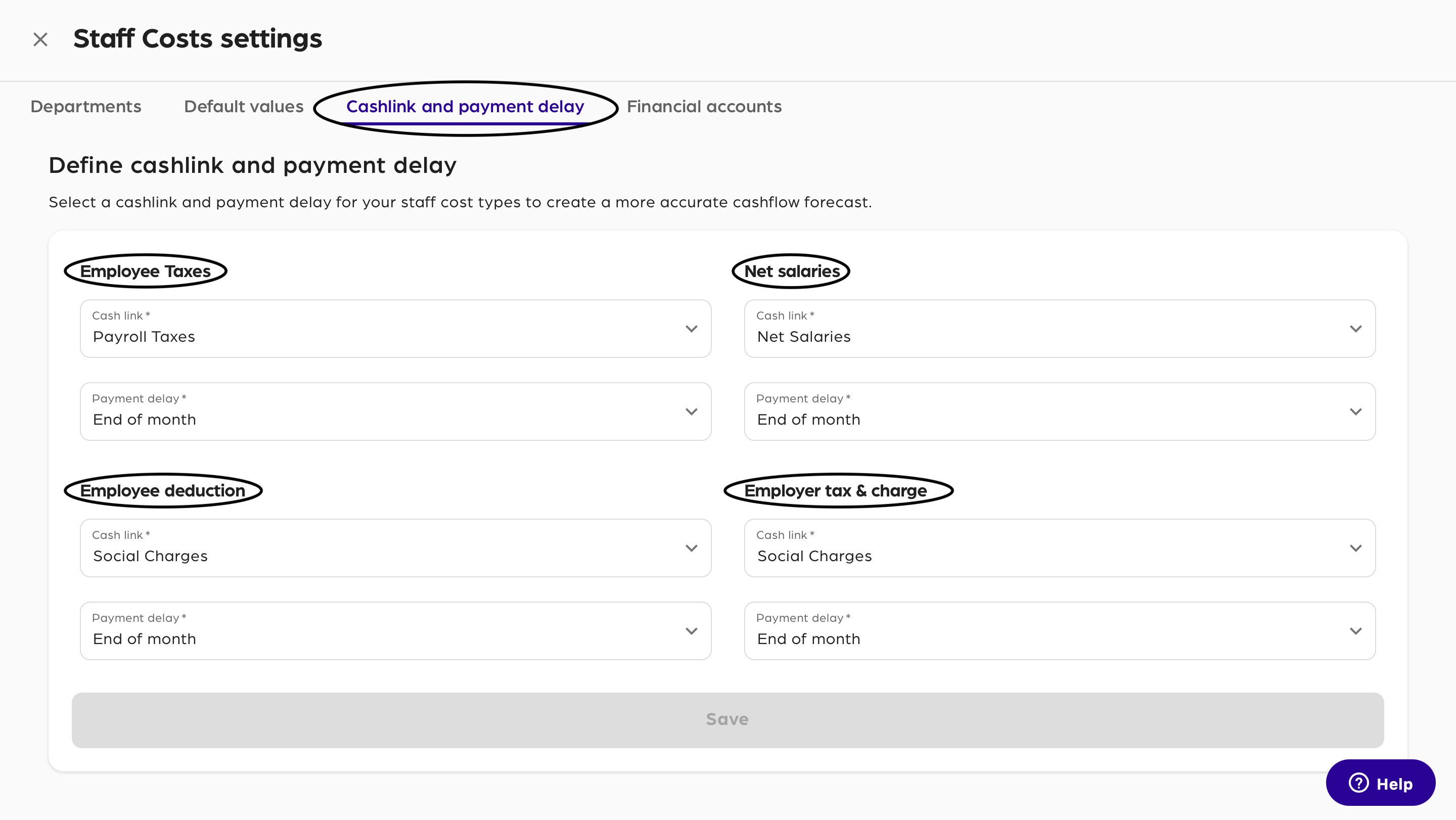

In the Staff Costs settings go to Cashlink and payment delay. Your employee's salary consists of various items which have different pay dates and different cash links. Taxes for example are often paid with a delay, salaries are paid within the month. You can individually set the payment delays/advances for your Employee Taxes, Employee deduction, Net salaries and Employer tax & charge. If you have employees in more than one country, consider that there may be different payment delays needed for different countries.

Confirm with Save.

Updated over 3 years ago