Investor & Lender Catalogue with Deal Criteria

Stakeholder Environment

Many investors and lenders co-invest with other investors and lenders. Matchmaking co-investment opportunities is one of Calqulate's features and it relies on the deal criteria of the organization's investor and lender network.

All investors and lenders have an investment thesis and that translates into deal criteria. The potential investment opportunities are analyzed against the deal criteria. The deal criteria is usually a combination of numerical/financial and non-financial/non-numerical data.

The financial deal criteria can for example be the target company's Annual Revenue, Growth Rate % and LTV to CAC ratio. The non-financial deal criteria can for example be the target company's revenue model, industry, country or investment stage.

This article explains how deal criteria can be set up for your investor and lender network.

How to set up Deal Criteria for Investors & Lenders

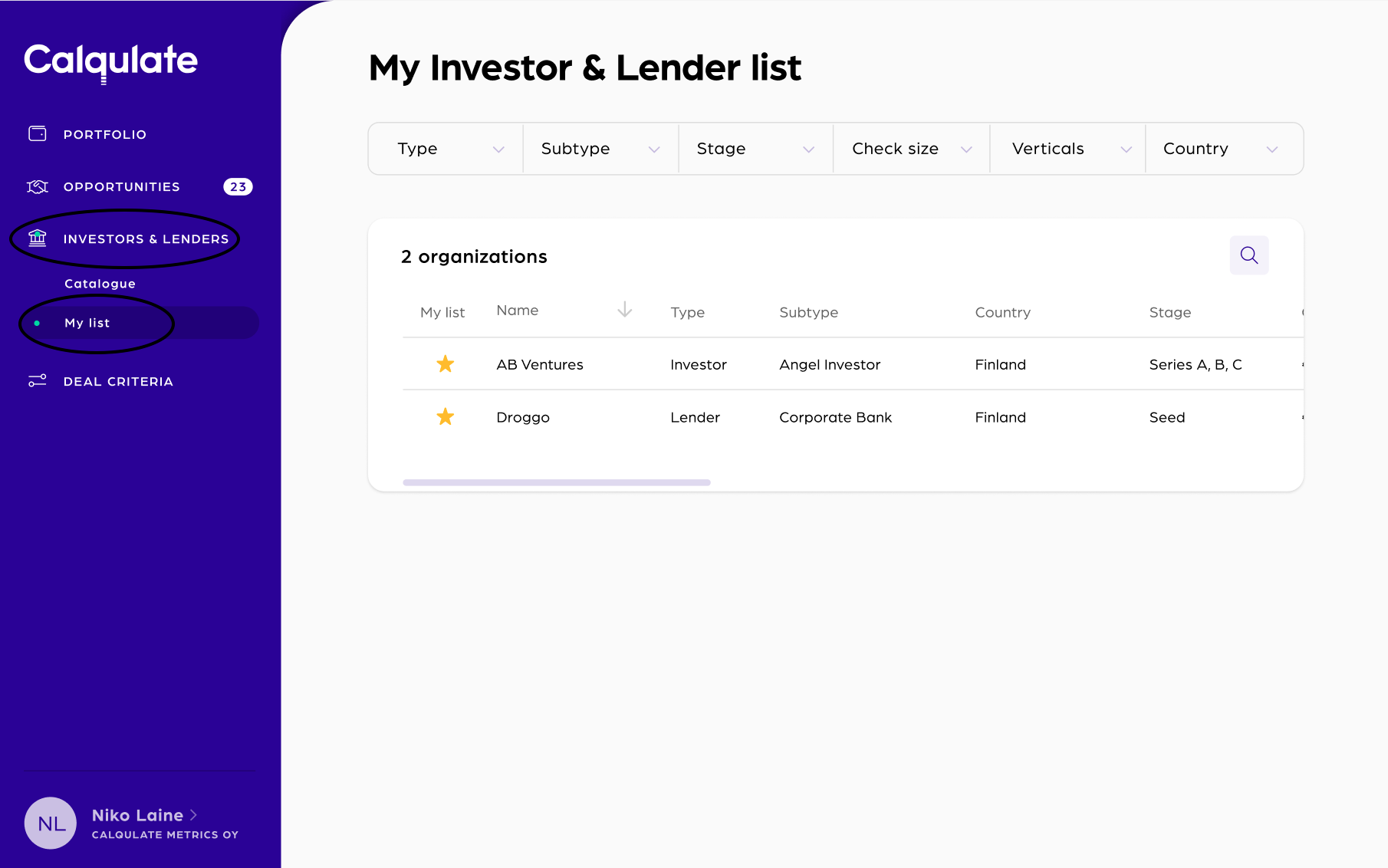

Deal Criteria for Investors and Lenders can be set up in My list which can be found in the left-hand menu under INVESTORS & LENDERS.

My list displays all Investors and Lenders that have been added to the organization's network. On the right side in the Deal criteria column the number of deal criteria is displayed. Deal criteria can be adjusted or added by clicking on the Name of the respective investor and lender.

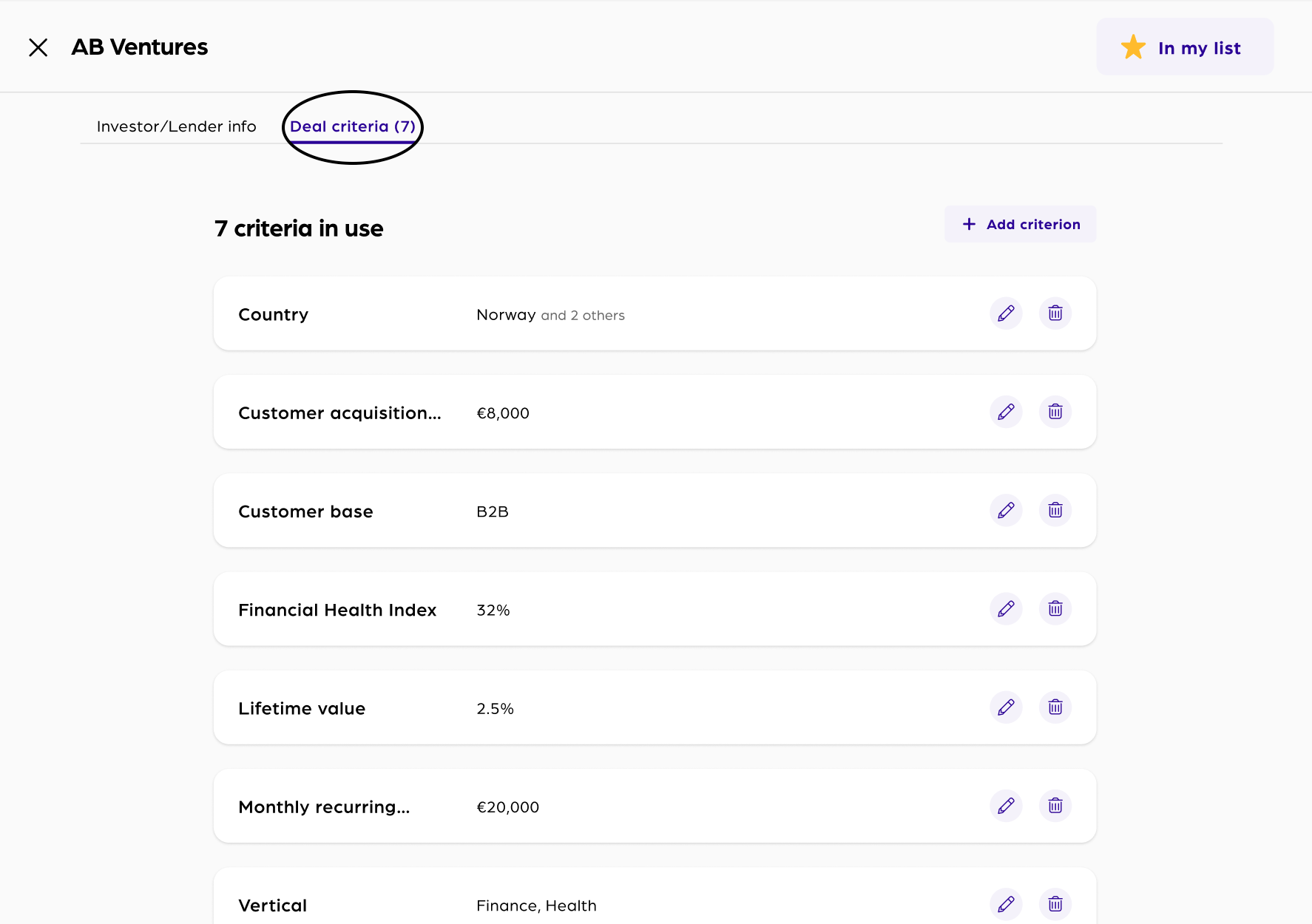

Within the Investor/Lender profile, the criteria can be added or adjusted through the Deal criteria tab.

How to add or adjust deal criteria in detail is further explained in this article.

Updated over 3 years ago