Finding your Staff Cost in the Cashflow Forecast

Cash Management

Keeping track of your employees salaries is essential when running a business. The cashflow forecast allows you to see your employees' actual and forecasted salaries.

You have already added your staff costs and want to know where to find them in the Cashflow Forecast. If not check out this article about how to do it.

Finding your Staff cost

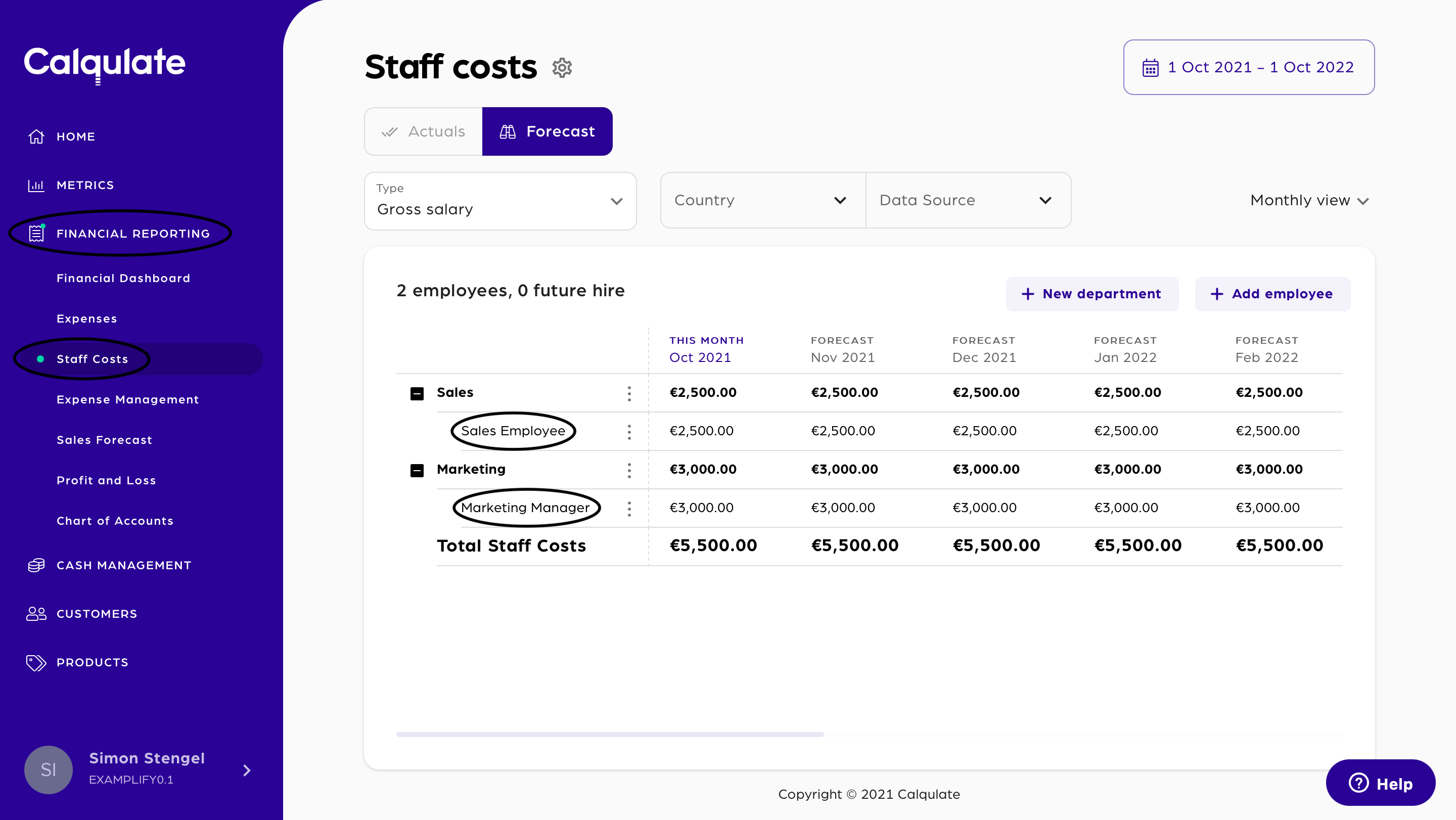

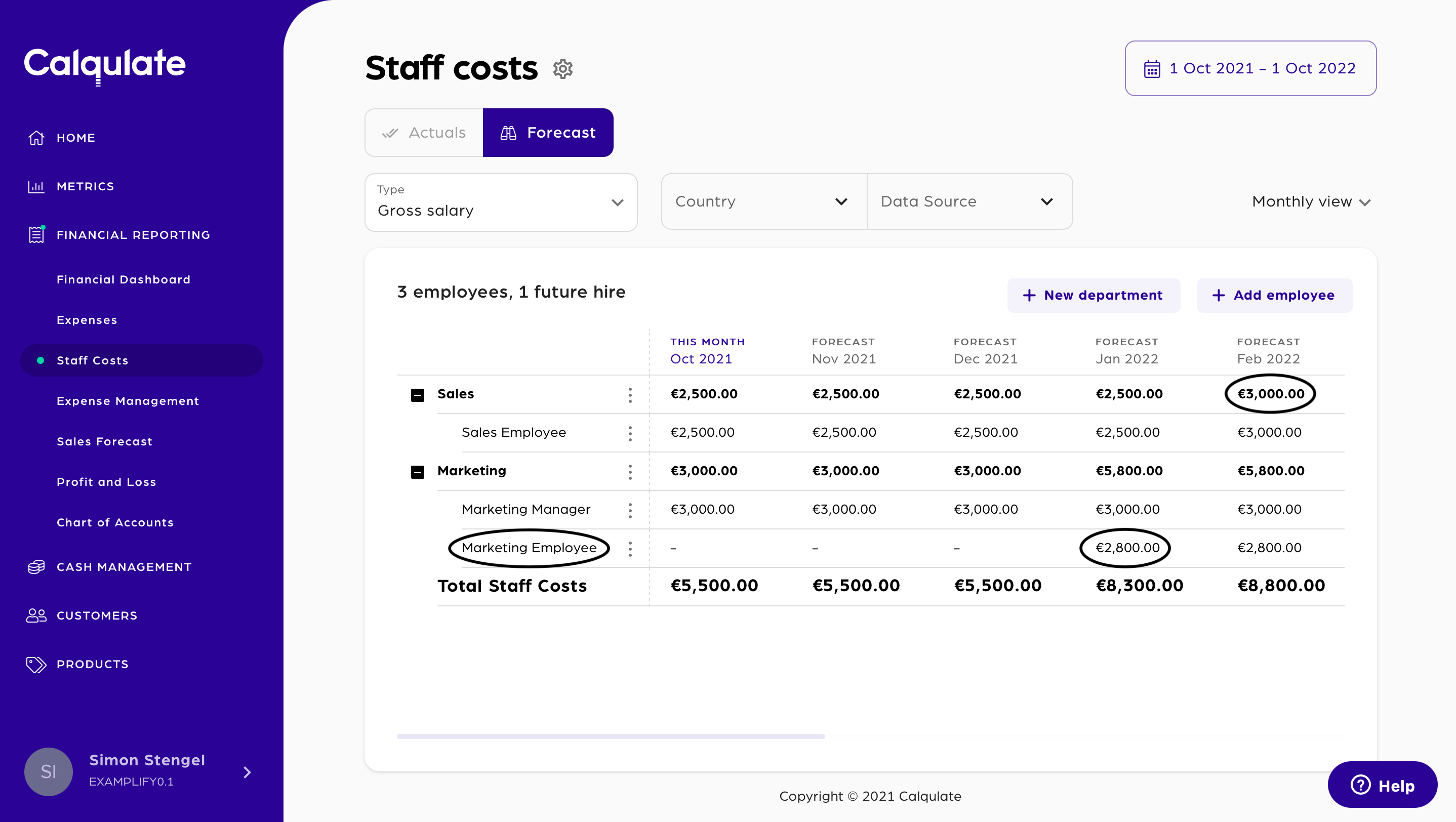

First, let's check the Staff costs. Go to the left-side menu FINANCIAL REPORTING > Staff Costs. You can now see all of your employees and their gross salaries. In this example, we have two employees.

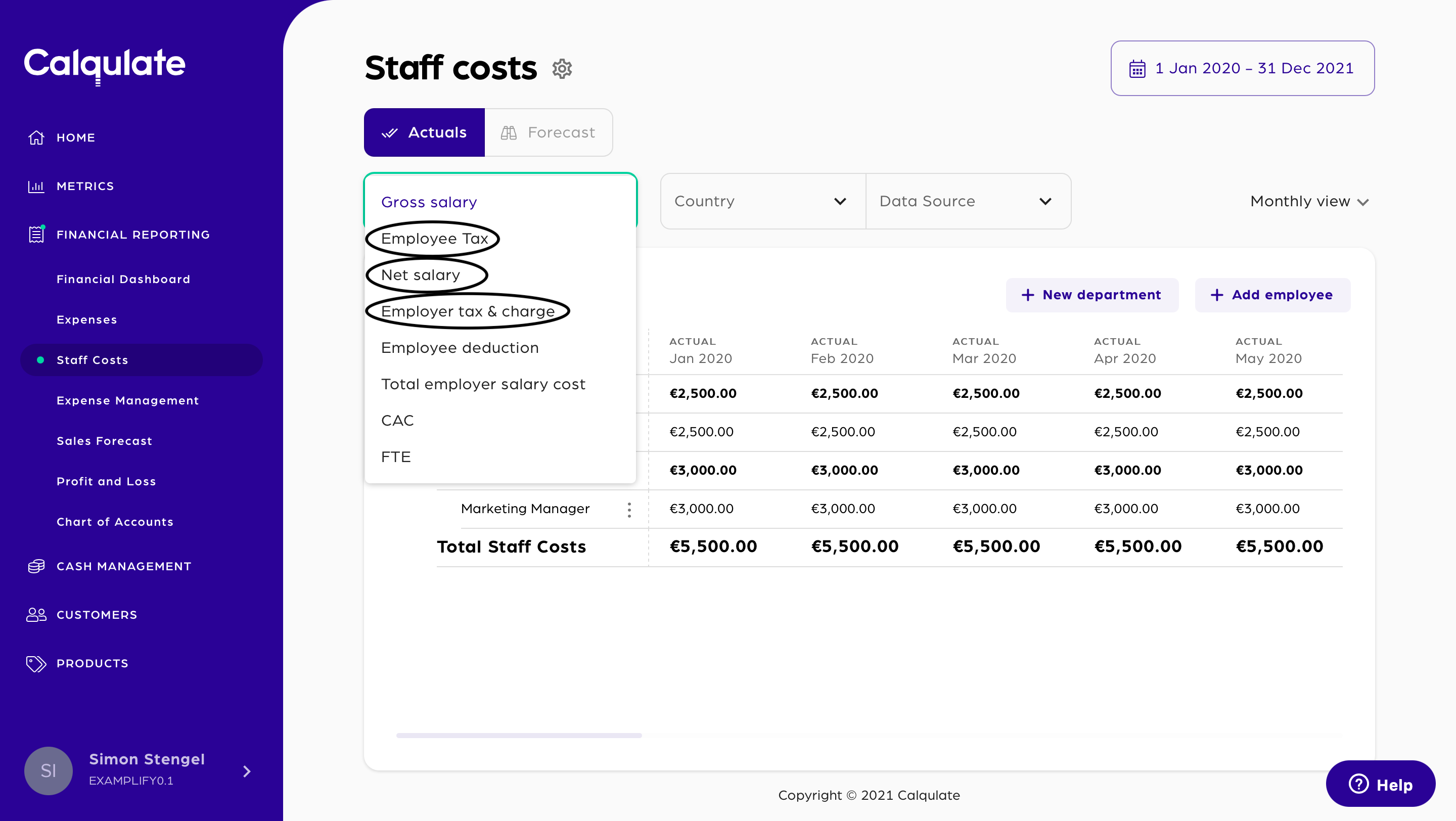

On the left top side of the screen you can choose the displayed Type of Staff costs from the drop-down menu.

- Choose Net salary from the Type dropdown list and you will see the net salaries of all your employees and the total net salaries.

- Choose Employee Tax from the Type dropdown list and you will see the withholding taxes of all your employees and the total withholding taxes.

- Choose Employer tax & charge from the Type dropdown list and you will see the employer taxes and charges that relate to all your employees and the total employer taxes charges.

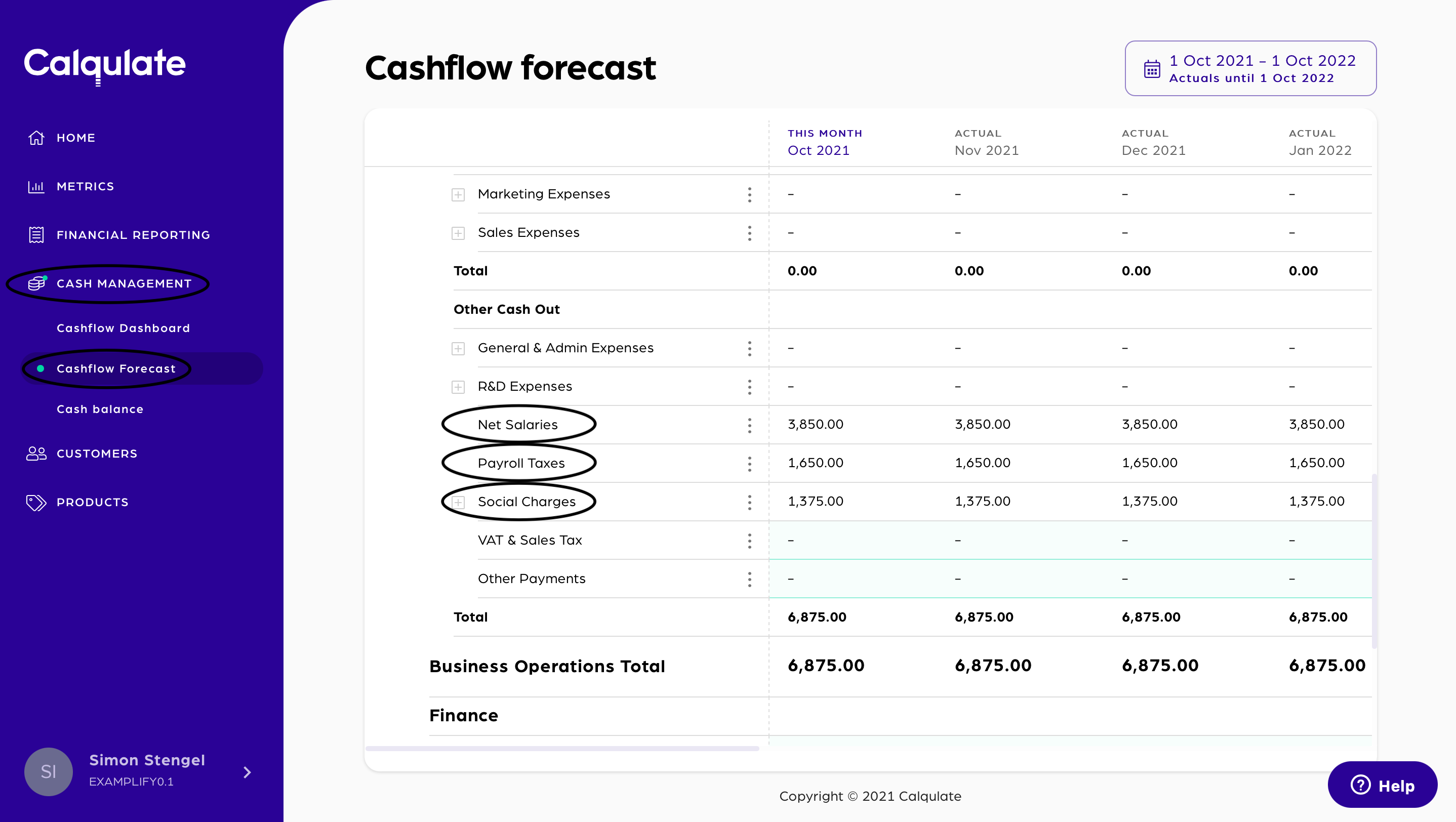

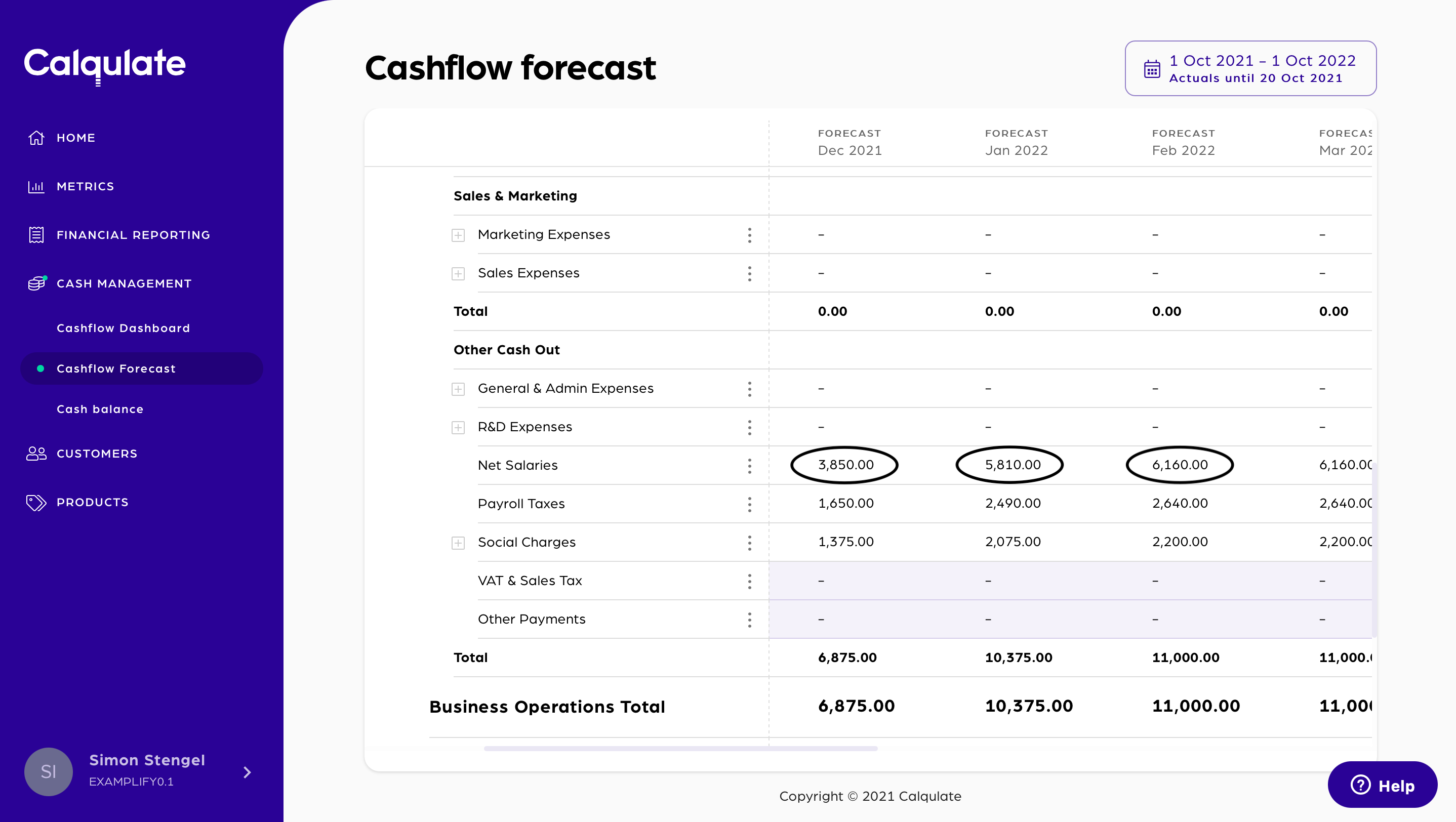

Now we want to check the salaries in the cashflow forecast. Go to the left-hand menu CASH MANAGEMENT > Cashflow Forecast. Here, you can see the total amount of net salaries, employee withholding taxes and employer tax&charges that you are paying.

How to use this data?

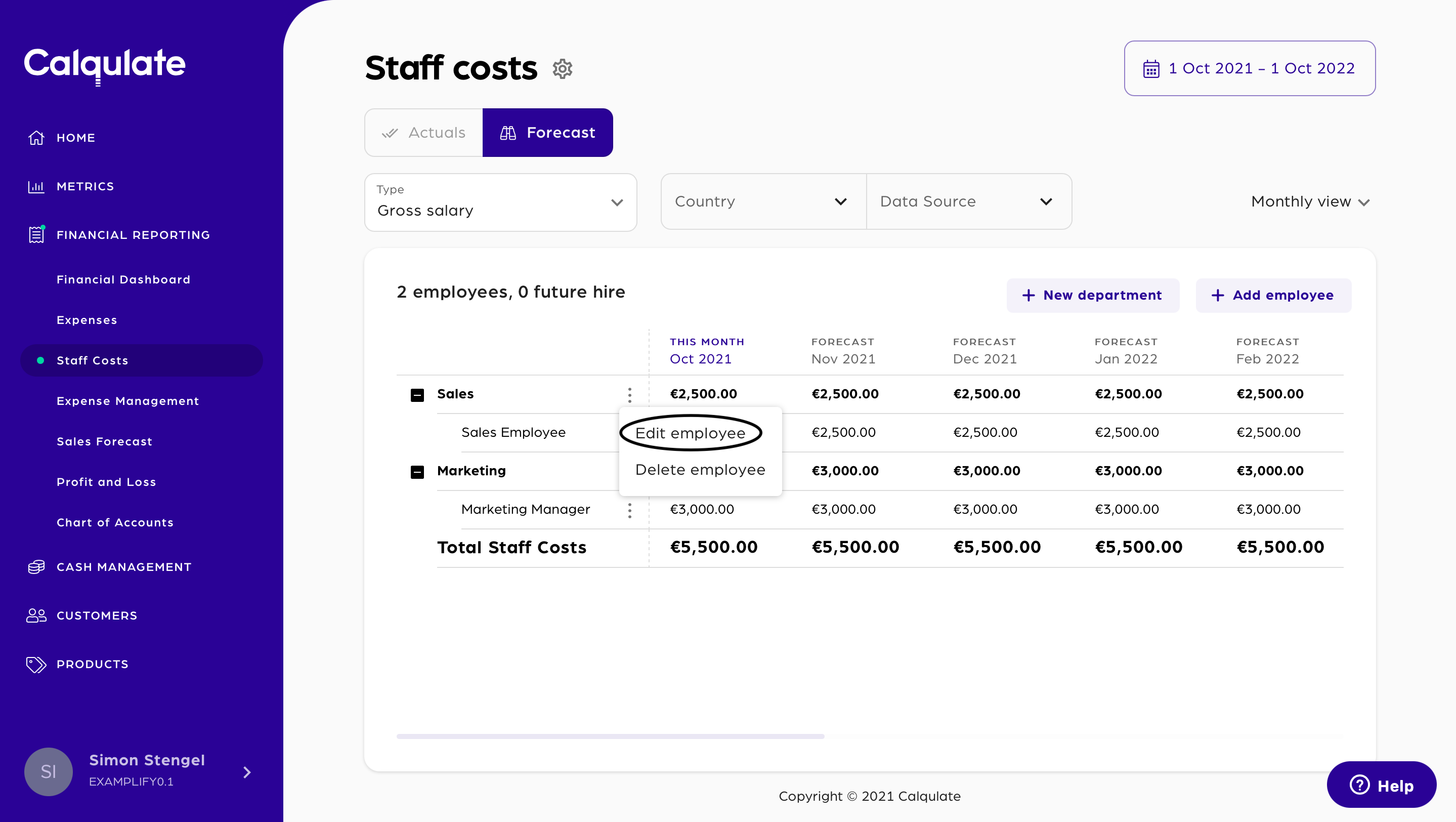

If you want to evaluate if you can afford to raise an employees salary, you can go back to the left-side menu FINANCIAL REPORTING > Staff Costs.

To do so, click the three-dot action menu next to their name and go to Edit employee and select the forecast view. Change the gross salary in the month you want to start the pay rise. It will automatically continue for the future. If you have an employee starting in the future, you can also add a future hire.

Note: If you give a pay rise in Calqulate, it will not affect your actual payments. You have to have to set up the pay rise for your future employee in your payroll software.

You can now see your future hire or the impact of the pay rise in your staff costs and also your cashflow forecast.

In this example, a new Marketing employee is starting in January 2022 and a pay rise for the Sales Employee will begin February 2022.

If you now return to the cashflow forecast, you see your updated cashflow forecast.

Updated over 3 years ago