Deferred Revenue

In accounting terms, any unrecognized revenue is still owed to your customer, even if you billed them upfront and they paid upfront. The balance of the unrecognized revenue is called Deferred Revenue. Deferred revenue is recorded as a liability in your Balance Sheet.

Let’s use as an example a company which sells Personal training with subscriptions. One month costs $100. The customer subscribes for one year and pays upfront in January. The company gets $1200 in January. However, they do not own the whole amount of money, yet. Since only $100 of revenue belongs to January, the rest, $1100 is assigned to deferred revenue.

| Jan. | Feb. | March | April | May | June | July | Aug. | Sept. | Oct. | Nov. | Dec. | |

| Invoiced | 1200 | - | - | - | - | - | - | - | - | - | - | - |

| Rev. rec. | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 |

| Def. rev. | 1100 | 1000 | 900 | 800 | 700 | 600 | 500 | 400 | 300 | 200 | 100 | - |

In the second month, $100 is the revenue for this month, the deferred revenue decreases by $100 to $1000. Deferred revenue decreases every month until it diminishes in the last month.

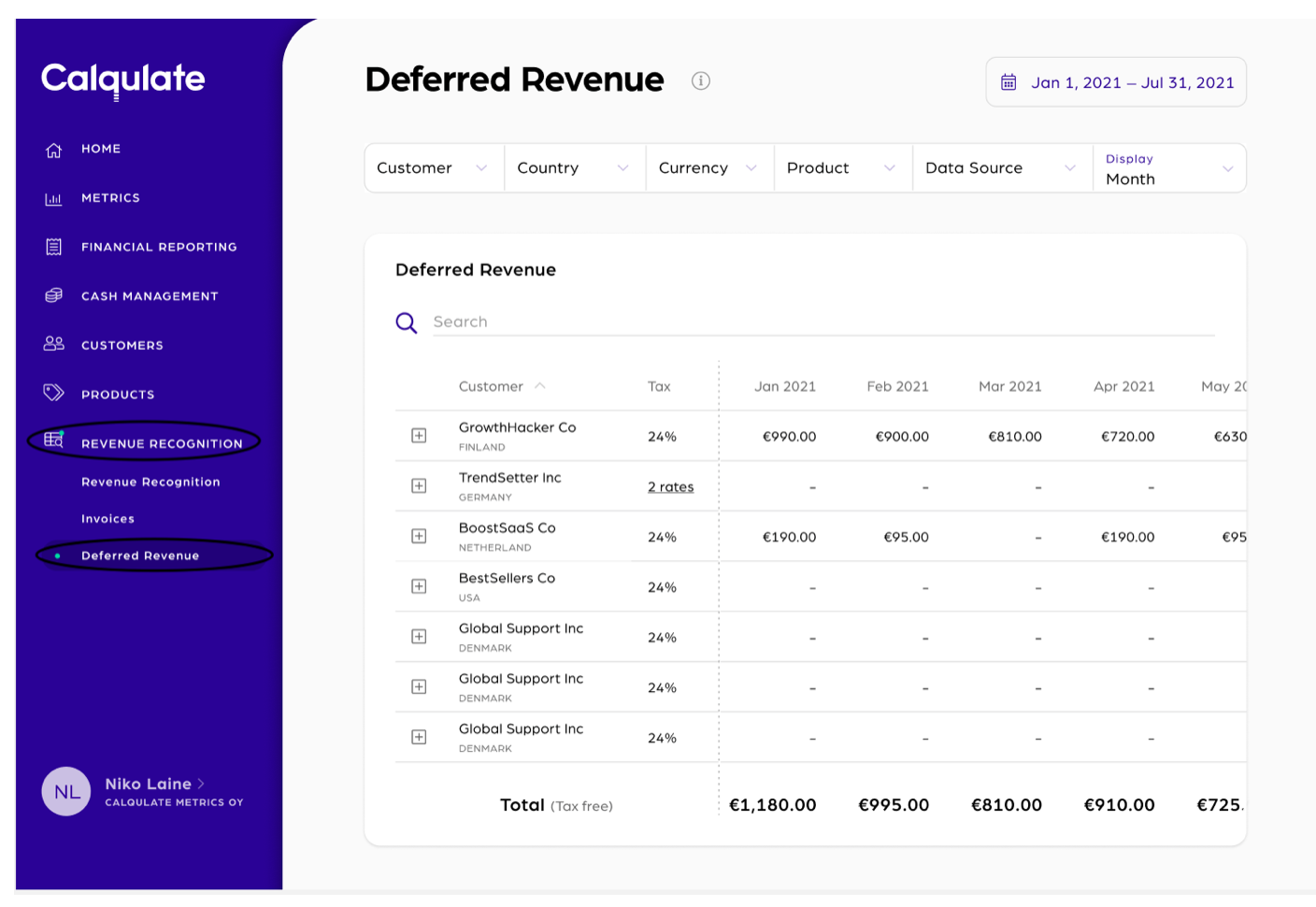

Where to see Deferred Revenue in Calqulate

Go to the left-hand menu and click REVENUE RECOGNITION > Deferred Revenue. You can check there that your deferred revenue is decreasing month by month unless you send another invoice to the customer.

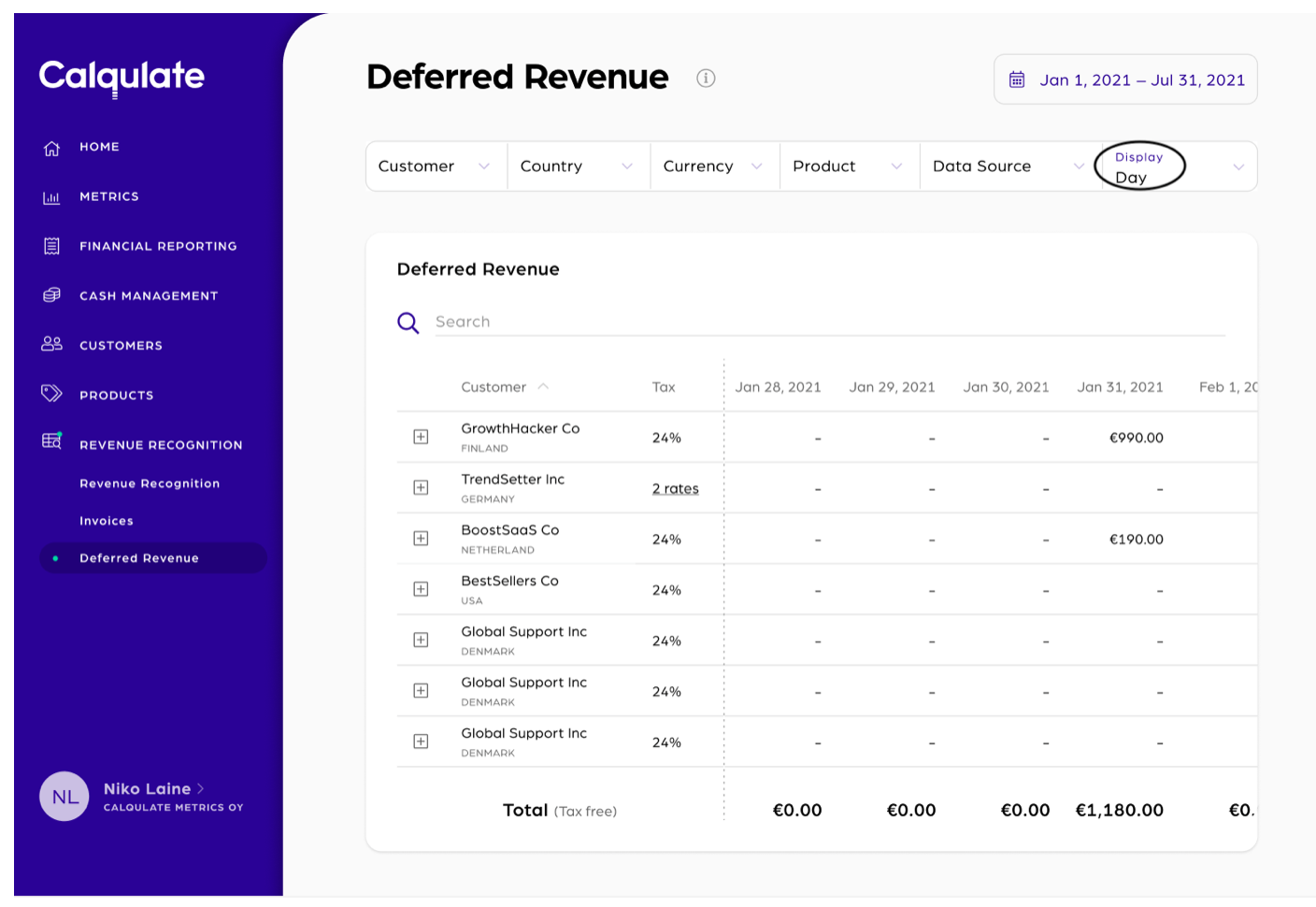

Click on Display and choose Day it will display your deferred revenue on a daily basis. Revenue recognition and deferred revenue are always booked on the last day of the month.

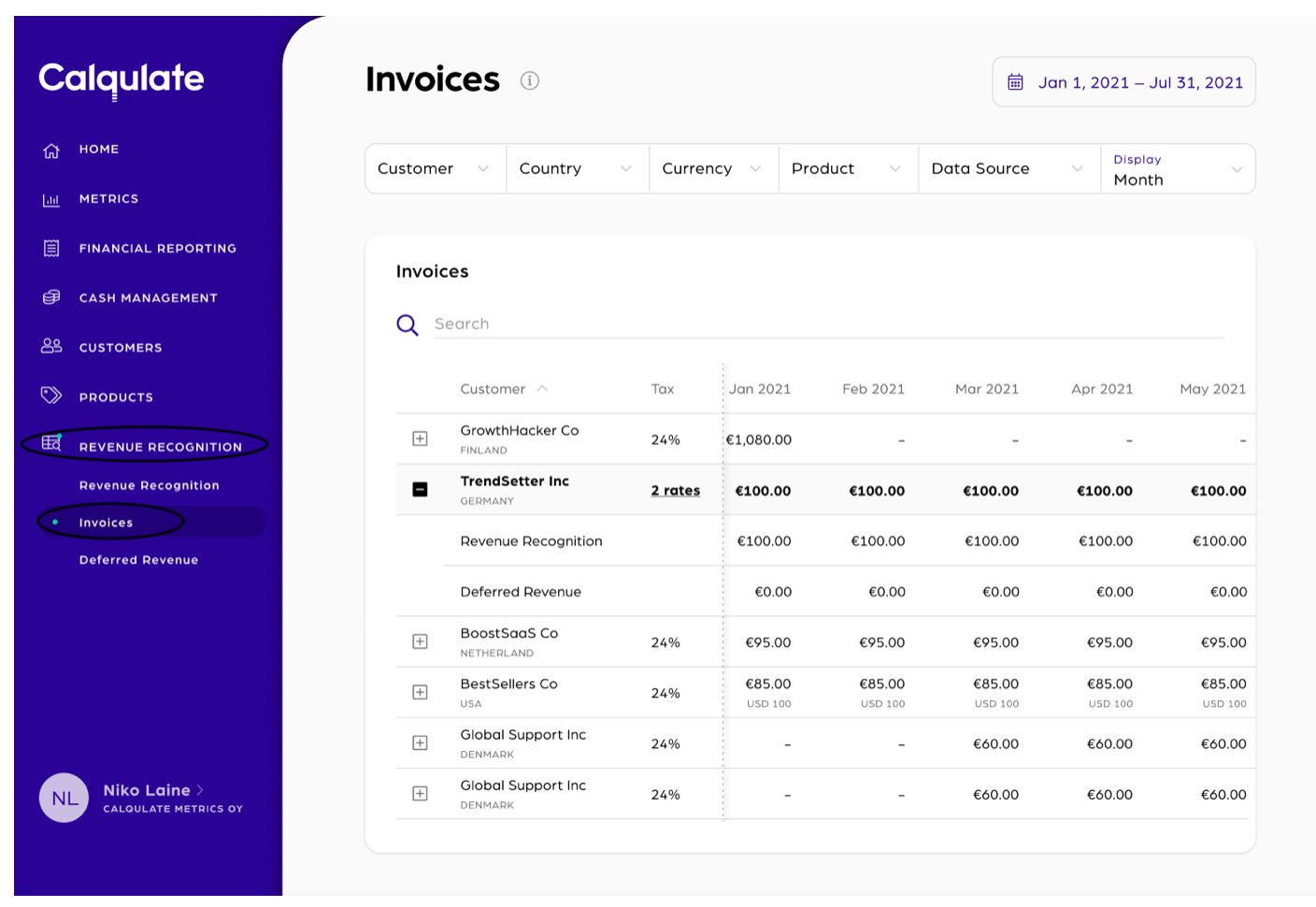

Invoices

Go to the left-hand menu and click REVENUE RECOGNITION > Invoices. You will now see your Invoices displayed by customers.

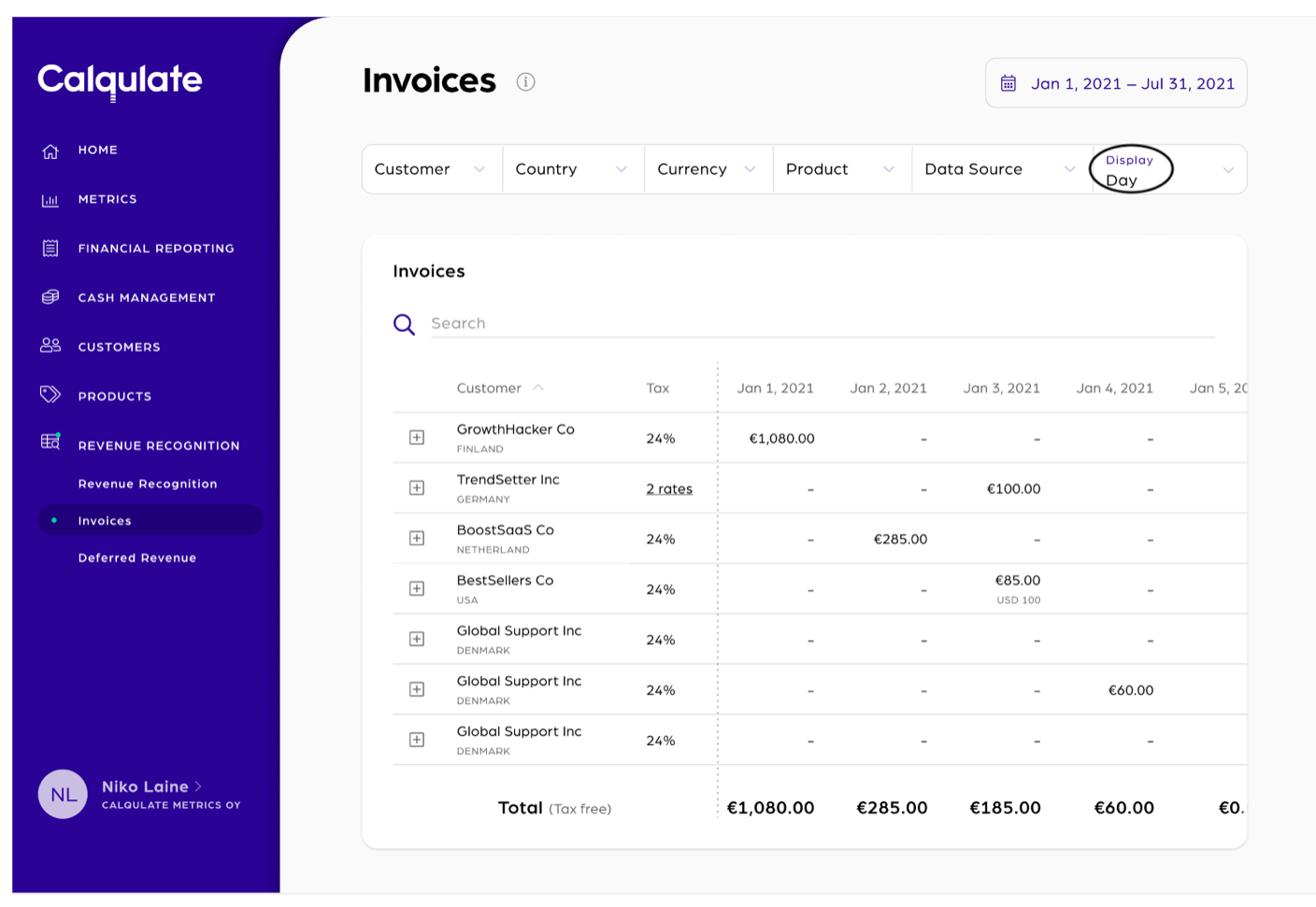

Click on Display and choose Day your invoices will be displayed on a daily basis. The invoices will be shown as per the invoice date.

Updated over 3 years ago