Invoices

Revenue Recognition

Revenue recognition calculations are done on a monthly basis. However, subscriptions are often paid annually, semi-annually or quarterly. Keeping track of your MRR and your revenue recognition can thereby become difficult. That is why we calculate the deferred revenue and the revenue recognition for you. If you do not know what those terms mean or you want to refresh your memory, read our articles about them. You can find them linked at the bottom of the page.

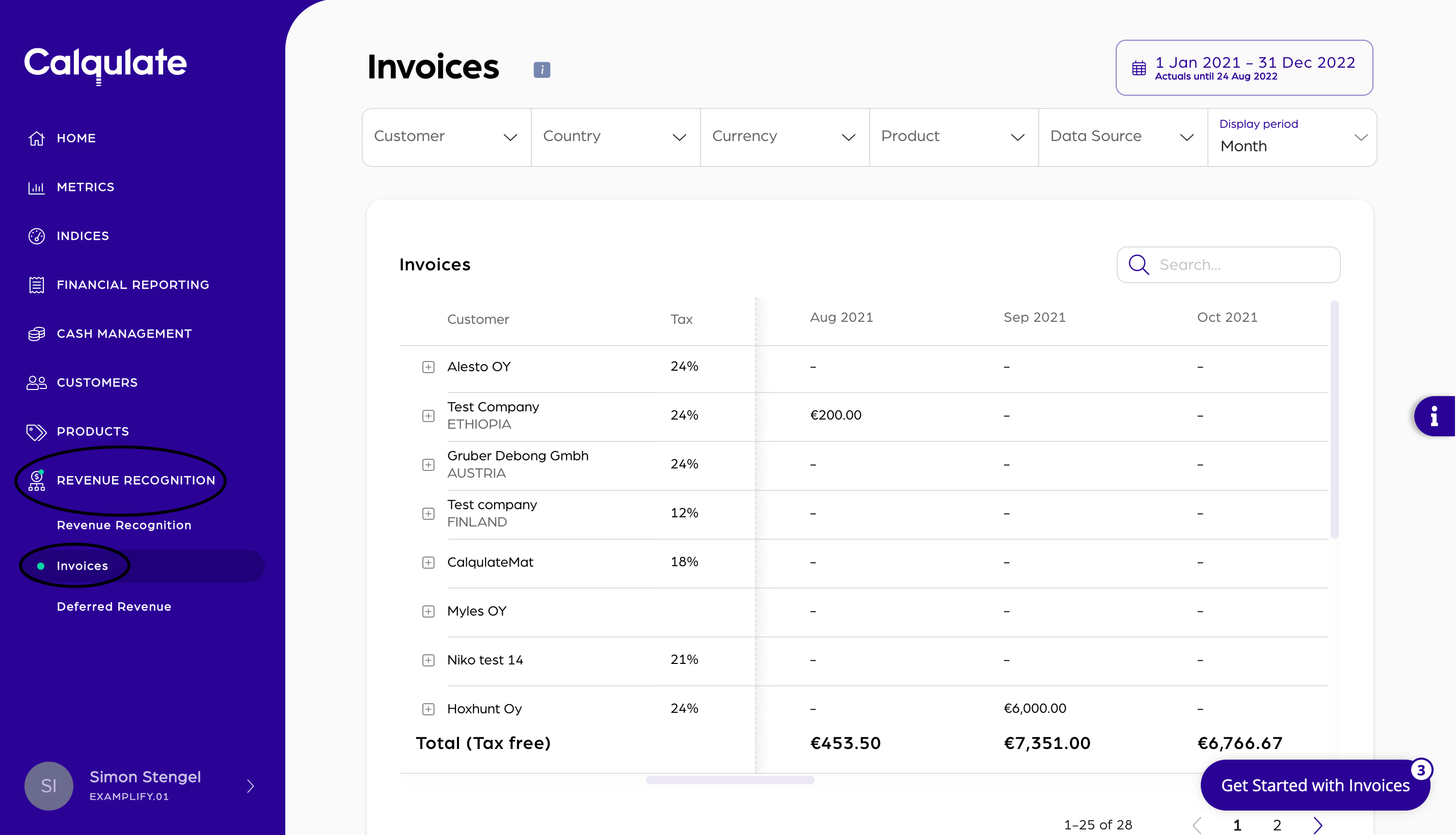

Where to find your Invoices?

To find your invoices, go to the left-hand menu REVENUE RECOGNITION > Invoices.

You can now see a list of all invoices in Calqulate for the selected time period. Revenue recognition is done on a monthly basis and takes place on the last day of the month.

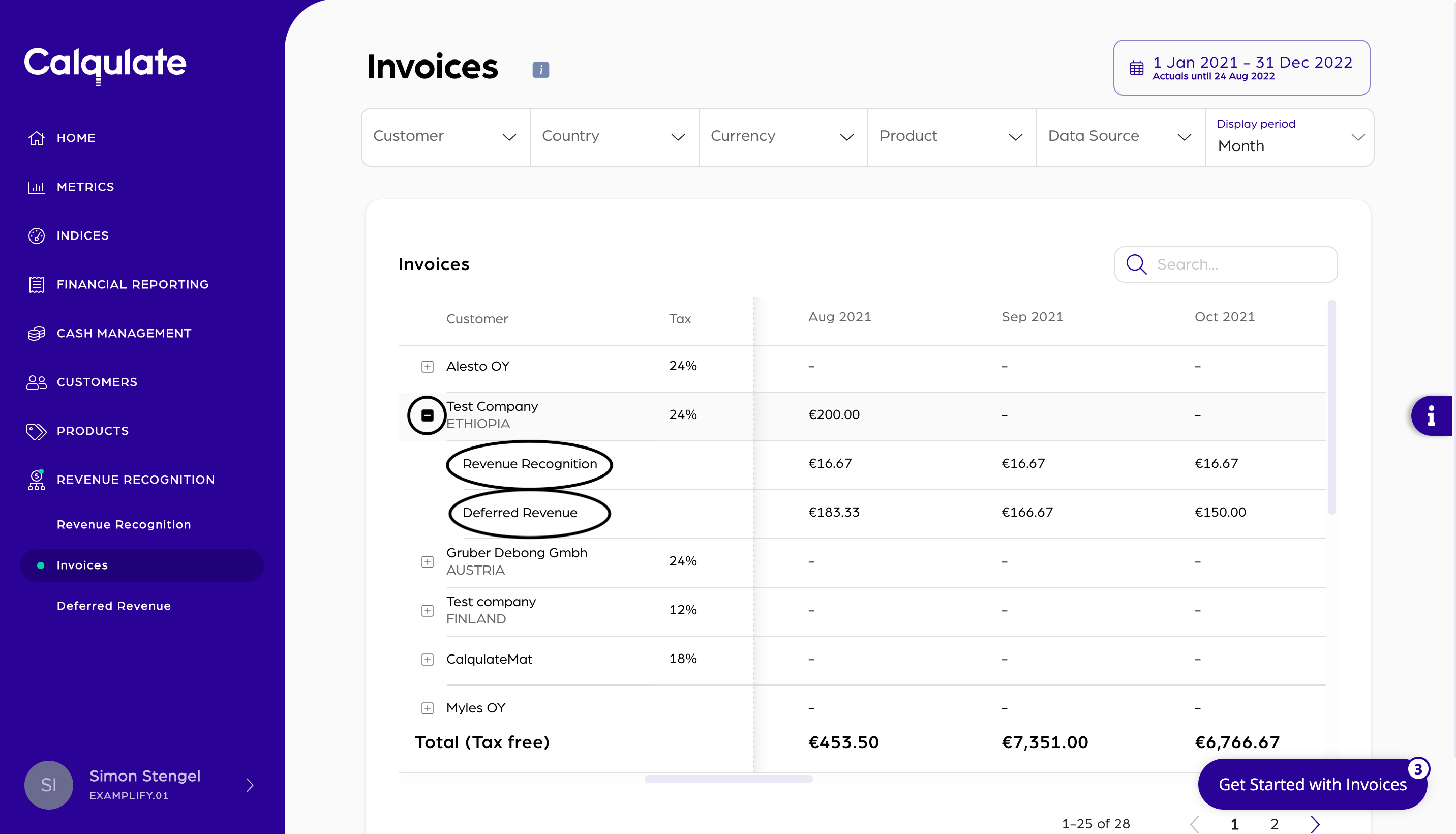

To check the revenue calculations for a certain invoice, press the plus icon next to the customer name.

In the example below the customer is billed €200.00 annually. This means the revenue recognition calculates €16.67 (200/12) per month and the deferred revenue at the end of the first month is €183.33.

Updated over 3 years ago