Importing Invoice CSV data

Financial Reporting

Important: Invoice CSV data MUST be uploaded after both customer and product data

Comma Separated Values or CSV files are data sources that can be used to import invoice data into Calqulate.

Once you upload your data in CSV format, Calqulate will automatically propagate the Sales Invoices menu with the information from your chosen file. This will allow you to enter data directly into Calqulate without having to perform any manual entry.

How to import an invoice CSV file

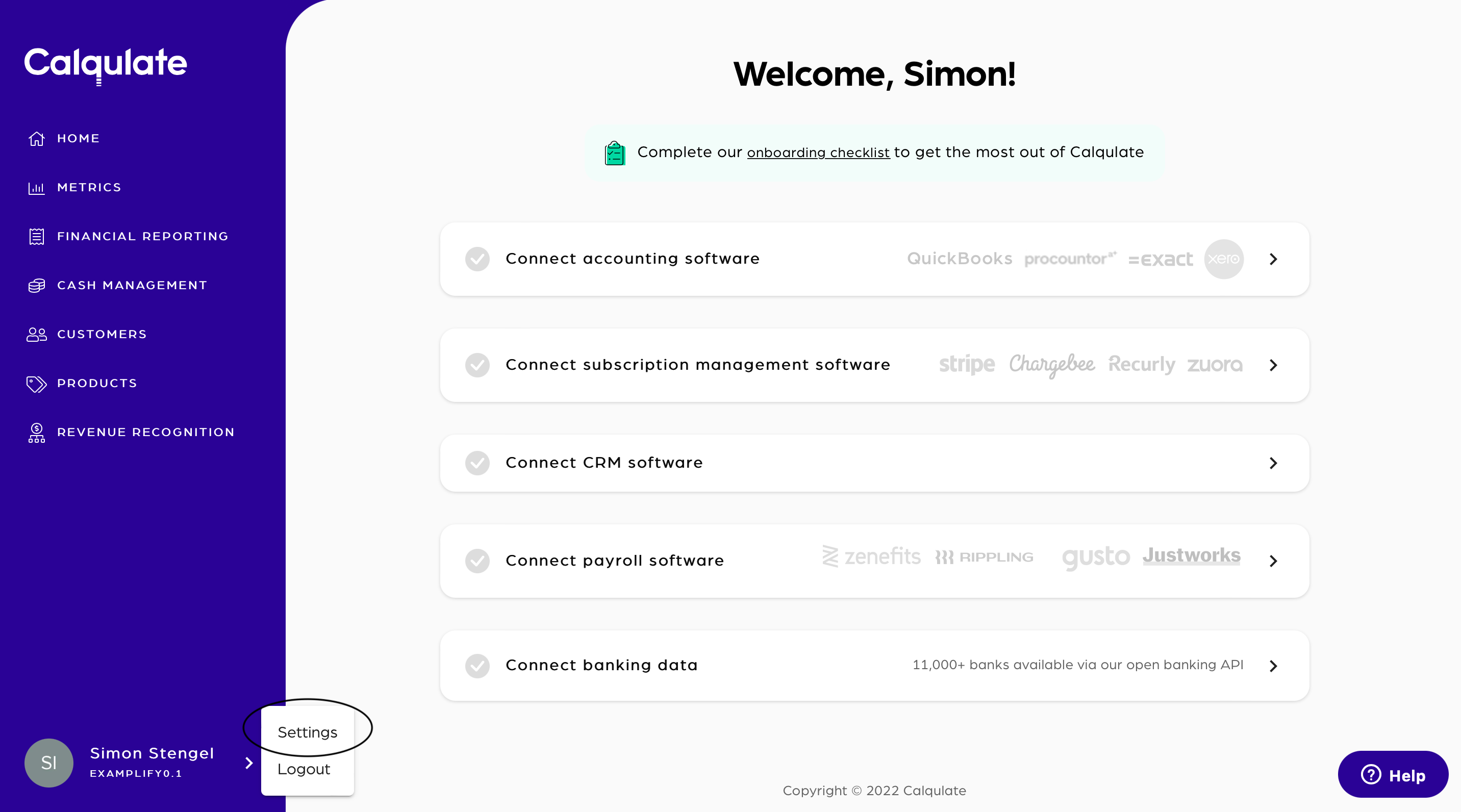

To begin navigate to the left-hand menu and click on your account > Settings.

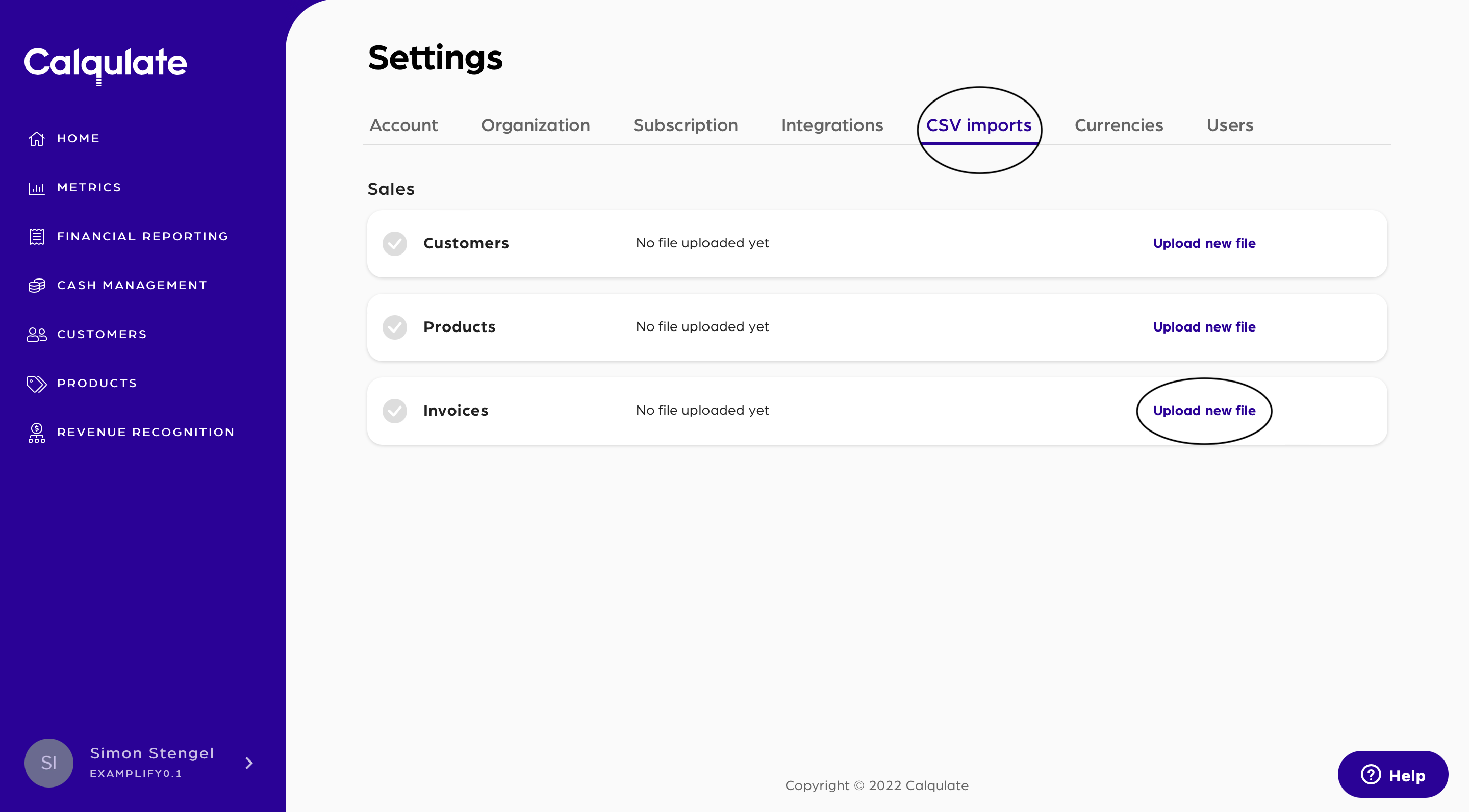

To upload your invoice data choose the CSV imports tab first. There you can decide if you want to upload Customers, Products or Invoice data. For uploading Invoice data click Upload new file in the Invoices section.

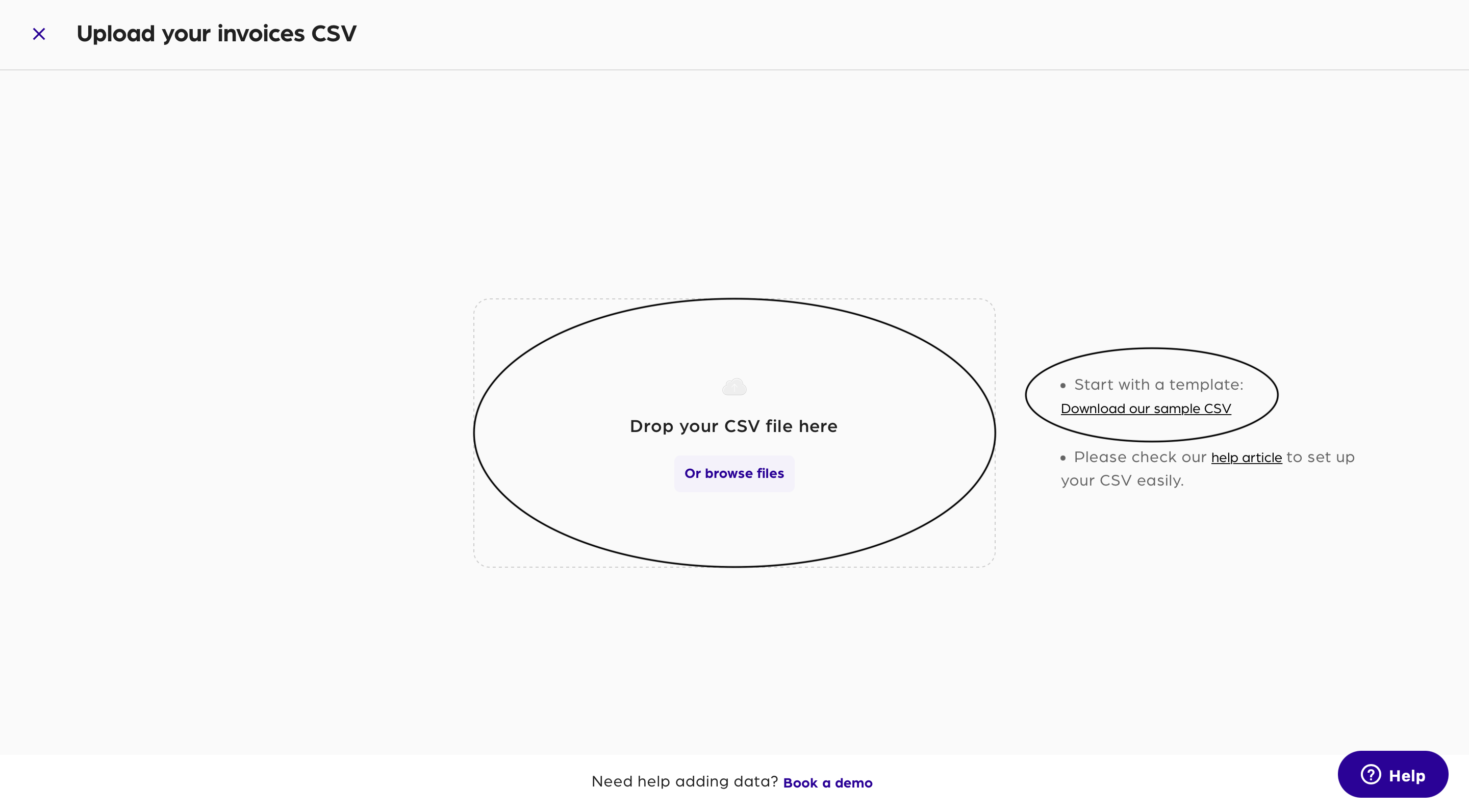

Then go to Download our sample CSV. The template there will make your life much easier. Fill in your invoice-related data and save the file.

After downloading and filling out the template with your invoice information, you can upload the file to Calqulate by dropping it into the box in the middle of your screen. Alternatively, you can also browse for the file.

Where to see the data from an imported CSV file

When this is complete, the data from the file will appear in the left-hand menu CUSTOMERS > Sales invoices tab.

If you choose to upload an updated CSV file, Calqulate will recognize the data that was already put into the system and update it, even if no changes were made. This will allow you to continuously add to and update the CSV file you use without the risk of having repeated data points.

Data requirements

- invoice_date must be listed in the format YYYY-MM-DD

- customer_id must match the customer_id from Customers CSV import

- product_id must match the product_id from Products CSV import

- price must be listed as numerical value without special characters. For example, 100 EUR would be 10000, 50 EUR would be 5000. The price must be listed as unit price per billing period for example 10000 per month (billing_period 12) or 120000 per year (billing_period 1). Otherwise calculations will be incorrect.

- currency must be listed as 3 alphabetic characters. For example: EUR, USD, GBP

- quantity must be a whole number different from 0

- billing_type must be specified as either "one-off" or "recurring", if nothing is entered, the default value is "one-off"

- billing_period must be specified as either "month" or "year". If the billing_type was "one-off", leave blank

- billing_frequency must be a whole number other than 0. The default value is 1. When billing_period is "Month" and billing_frequency is "1" the customer is billed monthly, if it is "Month" and "3" the customer is billed quarterly, with "6" the customer is billed semi-annually. When the billing_period is "year" and the billing_frequency is "1" the customer is billed annually as well as when the billing_period is "month" and the billing_frequency is "12". Even though both options bill the customer annually, there is a difference in the unit_price. If your unit price is the annual subscription price choose "annual" and "1", if it is on a monthly basis choose "monthly" and "12". If "0" is entered for the billing_frequency, the row is rejected.

- start_date must be in format YYYY-MM-DD, required only if billing_type is "recurring"

- end_date must be in format YYYY-MM-DD, required only if billing_type is "recurring"

- due_date must be in format YYYY-MM-DD

- credit must be marked "true" if invoice was made on credit, mark "false" if invoice is regular. If nothing is entered the default value is "false"

- credited_invoice_id must be named only if credit is marked "true"

- discount must be numerical value with no currency sign or percentage; example: 24% discount is 24, 10 EUR discount is 1000.

- discount_type must be named either "percentage" or "amount"

- tax_rate must be a number without a % sign; example: 24% tax is 24

- tax_region must be 2 alphabetic characters representing a country (according to ISO 3166-1 Alpha-2, 2-digits); example: FI, US, UK

- tax_type must be listed either "vat", "sales", or "gst"

- total_without_tax must be listed as numerical value without special characters. The value should equal price quantity billing_frequency

- total_tax_amount must be listed as numerical value without special characters. The value should equal total_without_tax * tax_rate

- total_with_tax must be listed as numerical value without special characters. The value should equal total_without_tax + total_tax_amount

- all other headers must be written as text

Updated over 3 years ago