EBITDA

Financial Reporting

The EBTIDA feature will be implemented soon.

EBITDA stands for Earnings Before Interest, Tax, Depreciation, and Amortization. EBITDA is one of the most important profitability metrics in addition to Gross Margin.

EBITDA takes into account only expenses that are needed for running your daily business activities, and it excludes expenses that are related to your corporate/capital structure, investments and tax payments. Thereby, you get an idea of how your business is performing and how much cashflow you create.

For investors and lenders EBITDA means that they can compare apples to apples when they are comparing the financial performance of different companies.

If you want to learn more about EBITDA, check out this article.

Let's talk shortly about the difference between EBITDA and Net Profit in the Profit & Loss report. While the official Profit & Loss report (what your auditor wants to see) calculates your net income which is done by deducting all your expenses from your revenue, the EBITDA is calculated a bit differently. The EBITDA calculation starts from Net Profit and adds back interest, tax, depreciation and amortization expenses. Those expenses are not directly linked to your business activities. EBITDA thereby measure how you performed in reality.

Before Calqulate can accurately calculate your EBITDA you need to map your chart of accounts. Check out the instructions on how to do it in these paragraphs. This helps us to assign all your expenses to the right place in the Profit & Loss report which is needed to calculate your Gross Margin, EBITDA and Net Profit. If you have done this already, your accounts are all set up and you are ready to check out your EBITDA statement.

Where to find EBITDA details in Calqulate

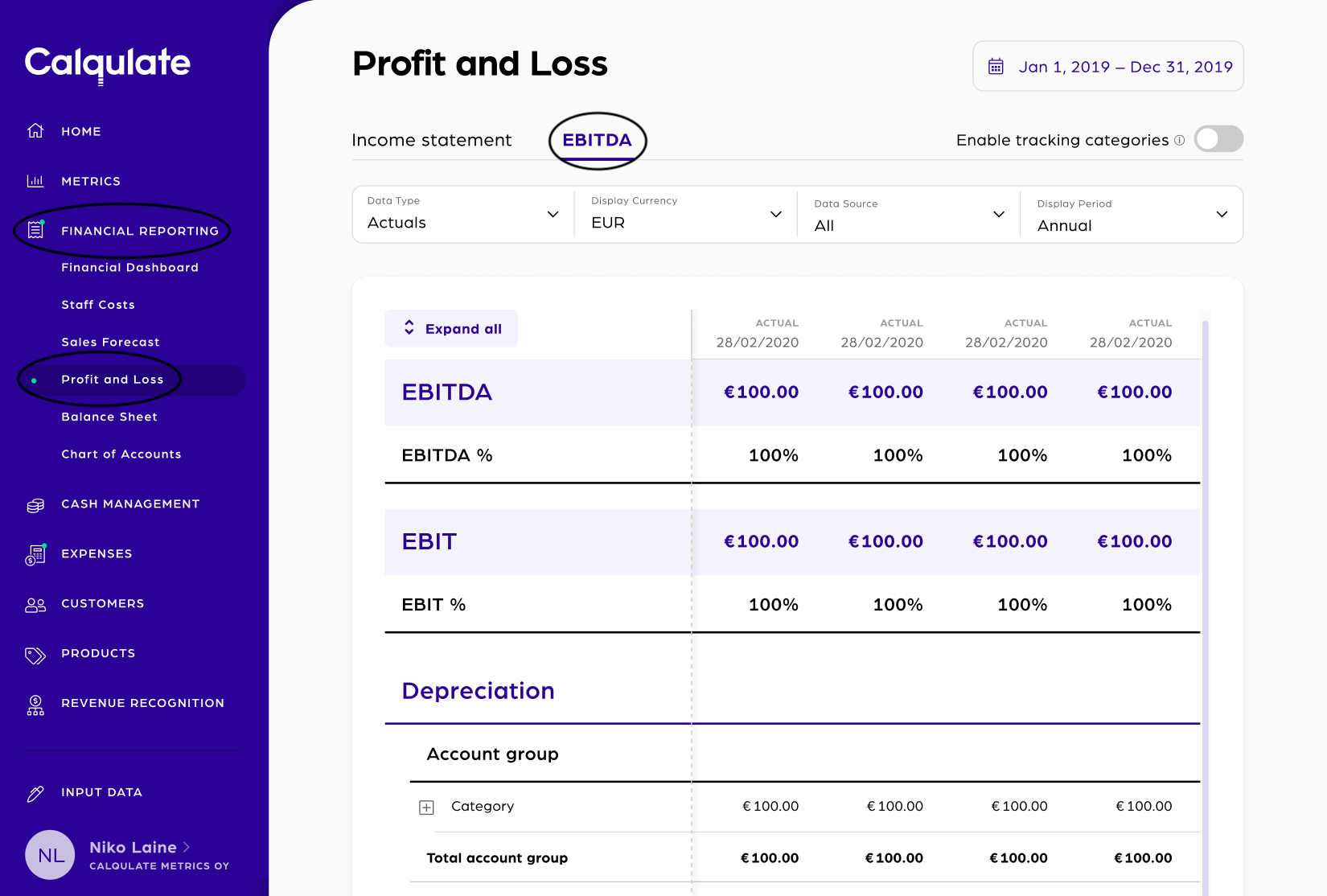

Go to the left-hand menu FINANCIAL REPORTING > Profit and Loss and choose the EBITDA tab.

Below the EBITDA you can find the EBIT (Earnings before Interest and Tax). This is followed by a detailed breakdown of your Depreciation, Amortization, Interest and Tax expenses.

Updated about 3 years ago